One of the most fundamental decisions a trader makes is choosing the right time frame. The best time frame for trading on Quotex isn't a one-size-fits-all answer; it depends entirely on your trading style, personality, and how much time you can dedicate to the markets. This guide will help you understand the options so you can make an informed choice.

Understanding Trading Time Frames

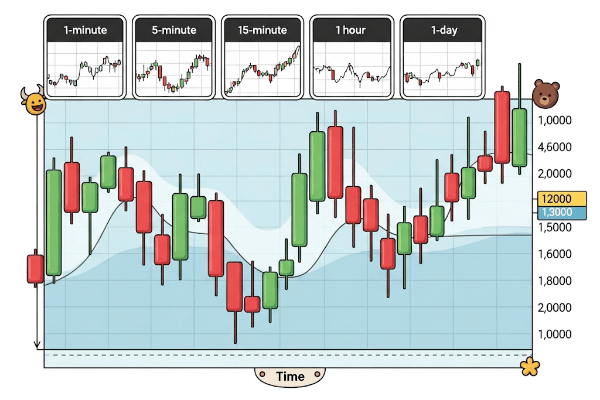

A time frame refers to the period that each candle or bar on your chart represents. For example, on a 5-minute (M5) chart, each candle shows the price action over a five-minute period. Shorter time frames show more detail and "noise," while longer time frames provide a broader view of the market trend.

Matching Time Frames to Trading Styles

Different trading strategies are suited to different time frames. Here are the three most common styles:

1. Scalping (Short-Term)

Scalpers aim to make numerous small profits throughout the day. They enter and exit trades very quickly, sometimes within seconds or minutes.

- Typical Time Frames: 1-minute (M1) to 5-minute (M5).

- Best For: Traders who can make quick decisions, stay highly focused, and dedicate several hours of uninterrupted time to trading.

2. Day Trading (Medium-Term)

Day traders open and close all their positions within a single trading day, avoiding overnight risk. They look for solid trends that can play out over several hours.

- Typical Time Frames: 15-minute (M15) to 1-hour (H1).

- Best For: Traders who have time to analyze the market at the beginning of the day and can check in periodically. This style requires patience to wait for strong setups.

3. Swing Trading (Long-Term)

Swing traders hold positions for several days or even weeks. They aim to capture larger market "swings" and are less concerned with short-term fluctuations.

- Typical Time Frames: 4-hour (H4) to 1-day (D1).

- Best For: Individuals who can't monitor charts all day. This style is great for people with full-time jobs, as it requires less active management.

How to Find Your Perfect Time Frame

The best way to discover your ideal time frame is through practice. Consider the following:

- Time Commitment: How much time can you realistically spend trading each day? Be honest with yourself.

- Personality: Are you patient enough for swing trading, or do you prefer the fast-paced action of scalping?

- Practice on a Demo: The single most effective method is to use the Quotex demo account. Test each trading style for a week to see which one feels most natural and yields the best results for you.

Remember that avoiding common beginner mistakes, like choosing a time frame that doesn't suit your personality, is key to long-term success. There is no magic formula, only what works best for you.